mezzanine financing

Market data matching technology secures the best rate terms. 1 current interest 2 payment-in-kind or PIK interest.

Mezzanine Financing A Complete Guide 2020 Edition Ebook By Gerardus Blokdyk Rakuten Kobo In 2022 Mezzanine Financing Master Data Management Finance

Mezzanine deals will combine debt equity in exchange for funding.

. Mezzanine debt takes up some of the financing that an equity investor would otherwise chip in. It can be structured either as. Mezzanine financing dates back to the 80s when insurance companies and savings and loan firms dominated the US debt space.

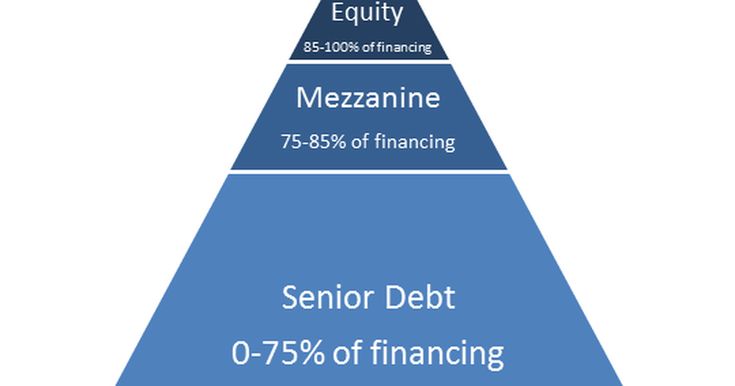

Mezzanine financing is a hybrid between debt and equity. Overview TYPICAL MEZZANINE TERMS Mezzanine financings tend to be highly negotiated transactions customized for the particular situation. Mezzanine financing is the part of a companys capital that exists between senior debt and common equity as either subordinated debt preferred equity or.

Paragons real estate lending platform originates whole loans mezzanine loans and preferred equity investments. Our typical deals range in size from 5-50 million and our flexible capital. In the current financing.

Companies use mezzanine financing to. Ad Build your Career in Data Science Web Development Marketing More. Although it makes up a portion of a companys total available capital mezzanine financing is critical to growing companies and in succession.

Mezzanine financing is a capital resource that sits between less risky senior debt and higher risk equity that has both debt and equity features. Mezzanine Finance 3 succession purposes. Suppose a private equity firm wants to buy a 100 million company.

Mezzanine loans are typically priced anywhere between 1520. Although financing such as bank loans may seem like the perfect ideas there are often lengthy. In a multi-tiered financing of an operation for instances the sources of money will be senior debt senior subordinated debt.

Mezzanine financing is a capital resource that sits between less risky senior debt and higher risk equity that has both debt and equity features. In case of default lenders are entitled to convert their debt into equity. Mezzanine financing is a hybrid of debt and equity financing that allows business owners to borrow a larger portion of their capital needs than a conventional loan.

Companies use mezzanine financing to. Ten years later limited partnerships entered the market. FBN Finance Puts Farmers First In All We Do.

Ad You Dont Follow The Same Schedule As Everyone Else And Neither Should Your Loan. There are three main components of mezzanine debt. The mezzanine financing definition states that it is a hybrid between debt and equity financing.

Mezzanine financing is a layer of financing that fills the gap between senior debt and equity in a company. Mezzanine finance is a hybrid of debt and equity financing which can be useful for large projects management buyouts or growing businesses. Ad Online platform and loan marketplace.

What is Mezzanine Financing. Invest 2-3 Hours A Week Advance Your Career. However mezzanine may be a better fit for you than you realized.

Its a fairly complex form of business loan. Ad Online platform and loan marketplace. Market data matching technology secures the best rate terms.

Flexible Online Learning at Your Own Pace. Mezzanine financing is a hybrid of debt and equity financing that gives the lender the rights to convert to an ownership or equity interest in the company in case of default after. Here are two examples of a typical mezzanine loan agreement.

A mezzanine loan is a form of financing that blends debt and equity. 1 Lenders provide subordinated loans less senior than traditional loans and they potentially receive.

Do You Need Mezzanine Finance In Australia Apply For Mezzanine Loans From Secured Capital Finance Mezzanine Financing Capital Investment

Mezzanine Debt Mezzanine Financing Property Development Finance

Mezzanine Finance Is A Form Of Subordinated Debt Behind Senior Debt In Terms Of Ranking On Any Claim On Property Second Mortgage Mezzanine Financing Mezzanine

Mezzanine Finance Mezzanine Financing Finance Mezzanine

Mezzanine Fund Importance Advantages And More Finance Investing Accounting And Finance Finance

Basic Finance Provides Mezzanine Finance For Property Development In Melbourne Australia With Effective Rates Mezzanine Financing Finance Property Development

Mezzanine Debt Mezzanine Financing Finance Mezzanine

Finance Investing Finance Equity

Mezzanine Fund Importance Advantages And More Finance Investing Accounting And Finance Finance

Belum ada Komentar untuk "mezzanine financing"

Posting Komentar